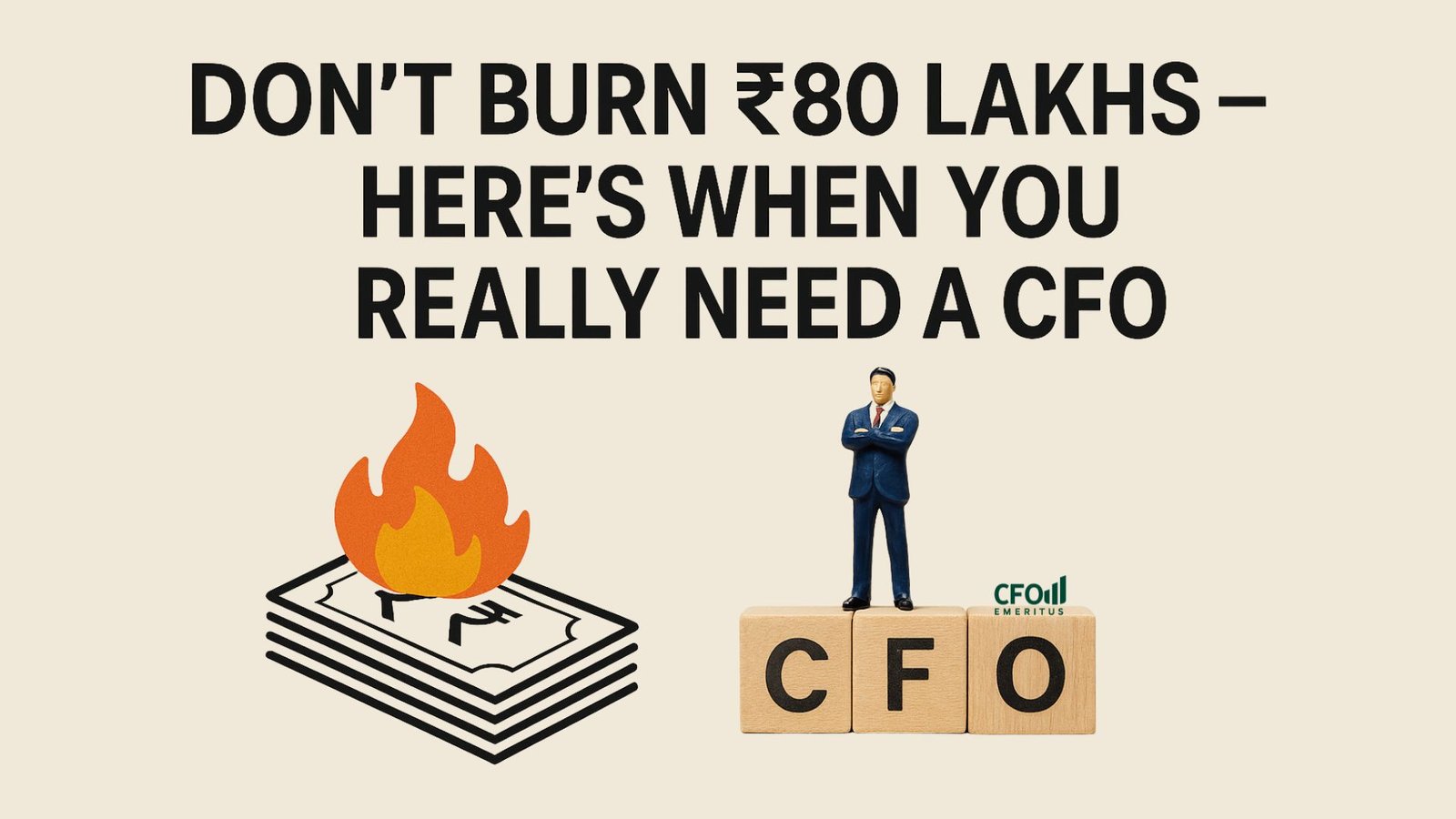

“Should we hire a CFO?”

I hear this question from founders all the time.

Here’s the truth: Hiring a CFO too early is wasted money.

Why pay ₹80–90 lakhs a year when you’ll still be chasing cash flow updates on WhatsApp?

What you need instead is the right finance structure at the right stage.

📊 A Simple Thumb Rule for Founders

-

At 0–10 Cr turnover → Keep your books clean. A good accountant + compliance support is enough.

-

At 10–50 Cr turnover → An analyst + a part-time Virtual CFO on call will give you strategy without the overhead.

-

At 50–100 Cr turnover → Yes, you need a CFO leading finance, but still on a fractional/outsourced basis.

-

At 100–200 Cr turnover → Your business now requires almost full-time CFO attention.

-

200 Cr+ turnover → That’s when it finally makes sense to bring a full-time CFO on board.

🎯 Final Thought

Hiring a CFO isn’t about prestige.

It’s about timing.

The right financial expertise at the right stage helps you avoid deadweight hires — while still keeping you investor-ready, compliant, and future-proof.

At CFO Emeritus, we step in exactly when you need us: as a part-time, scalable CFO service for startups and SMEs.

📩 Want to know if your business is at the right stage for a CFO?

Email us at office@cfoemeritus.com — and we’ll give you an honest answer.