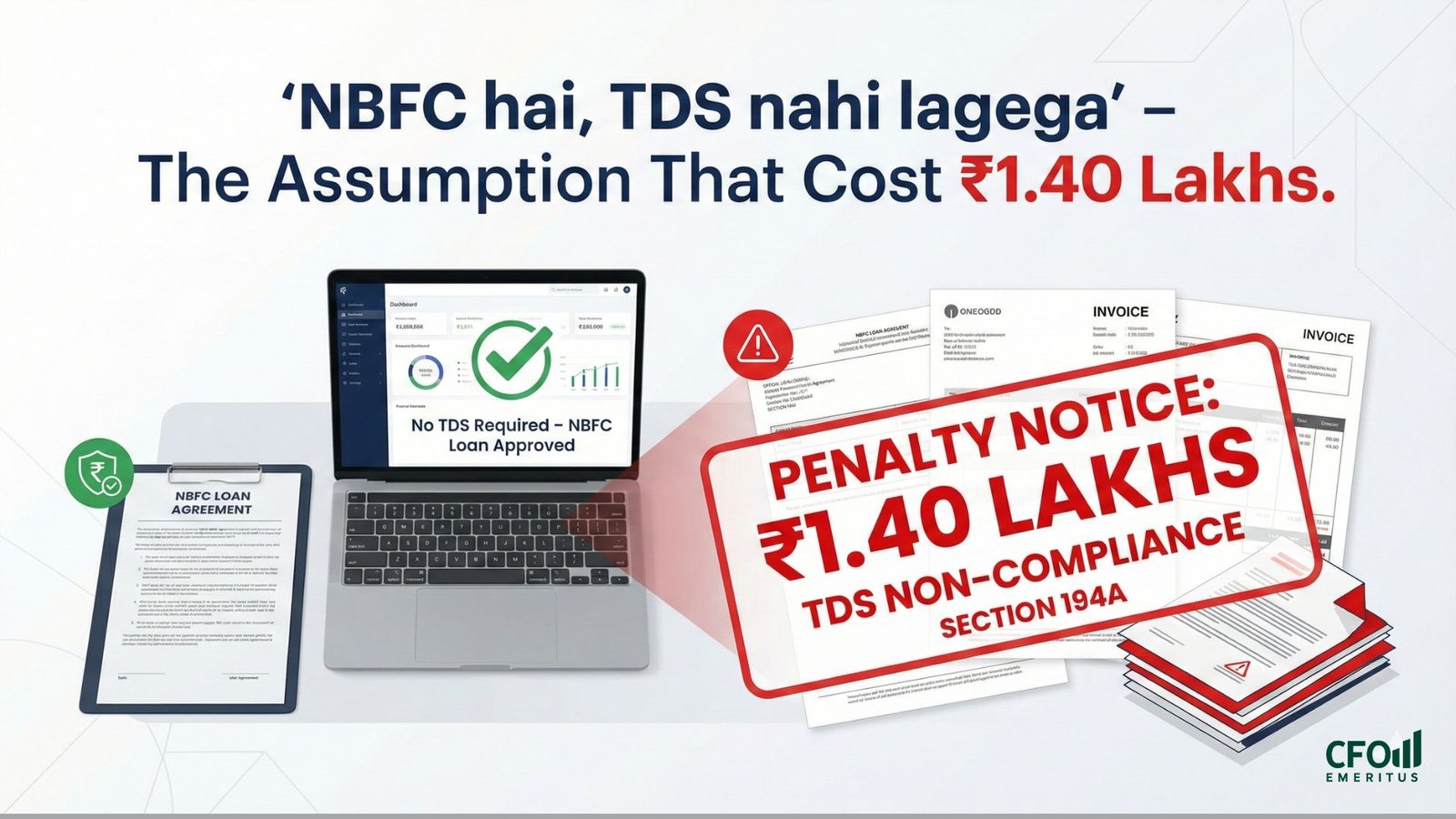

While finalizing a tax audit last year, we came across a ticking time bomb in a client’s books. Everything looked fine—sales were up, expenses were vouched.

Then we looked at the Interest on Loan ledger. The client had taken a substantial business loan from a well-known NBFC (Non-Banking Financial Company).

We asked: “Where is the TDS challan for this interest payment?”

The client’s accountant looked genuinely shocked.

“Sir, it’s an NBFC. Just like a bank. TDS isn’t applicable on bank interest, right?”

That single assumption cost the client approx. ₹1.40 Lakhs in additional tax liability.

Here is the breakdown of why this happens—and why “Auto-Debit” is not a valid excuse.

🏦 The “Bank vs. NBFC” Trap

Under the Income Tax Act, you generally do not need to deduct TDS on interest paid to Banks (Section 194A(3)(iii)).

Most founders (and many accountants) assume this exemption automatically extends to NBFCs (like Bajaj Finance, Tata Capital, Aditya Birla Finance, etc.).

❌ WRONG. The Income Tax Act does NOT treat NBFCs at par with Banks for TDS exemption. Interest paid to an NBFC attracts TDS under Section 194A.

If you are paying interest to an NBFC, you MUST deduct TDS (usually at 10%).

📉 The “Auto-Debit” Excuse

When we pointed this out, the accountant gave the standard defense:

“But Sir, the EMI is auto-debited from our bank account. The NBFC takes the full amount. How can I deduct TDS if I don’t control the payment?”

This is a practical problem, but legally, it is not a valid excuse.

The law requires you to deduct tax at the time of credit or payment, whichever is earlier. If the EMI is auto-debited in full, you must:

-

Deposit the TDS from your own funds to the Govt.

-

Issue a TDS Certificate (Form 16A) to the NBFC.

-

Claim a reimbursement or adjustment from the NBFC later.

You cannot simply skip it because “the system is automated.”

💸 The Consequence: Section 40(a)(ia)

Because the client failed to deduct TDS, the Income Tax Act (Section 40(a)(ia)) gave us no choice but to disallow the expense.

Here is the math of the damage:

-

Interest Expense Paid: ₹14.62 Lakhs

-

Action: Entire amount added back to profit (Disallowed).

-

Increase in Taxable Income: ₹14.62 Lakhs.

-

Additional Tax Liability (approx. 30%): ~₹4.38 Lakhs.

Let’s look at the specific impact for this client:

-

Interest Disallowed: ₹14.62 Lakhs

-

Tax Impact (approx.): ₹4.38 Lakhs (if 30% bracket).

The Client’s Reality:

-

Interest Disallowed: ₹14.62 Lakhs.

-

Result: The business profit artificially shot up.

-

Net Tax Impact: The client had to pay an extra ₹1.40 Lakhs in tax immediately.

📝 “Can’t We Just Get Form 26A?”

Yes, technically, there is a rescue clause. If the NBFC has already paid tax on that interest income, you can obtain a Form 26A from a Chartered Accountant certifying this, and the disallowance can be reversed.

But practically? Good luck. Try getting a specific compliance certificate from a massive NBFC after the financial year has closed. It involves endless follow-ups, emails to “customercare@”, and weeks of delay. Meanwhile, your tax audit deadline is ticking.

🎯 Final Advice

Go check your Loan Statements today. If you have a loan from an NBFC (not a Bank):

-

Check if TDS is being deducted.

-

If not, calculate the liability immediately.

-

Don’t wait for the audit to find out.

Don’t let a “system limitation” (Auto-Debit) become a “tax penalty.”

📩 Struggling with NBFC compliance? We help clients manage these “invisible” compliance traps before they become expensive audits. Write to us at office@cfoemeritus.com