I get this question often, usually followed by a long silence.

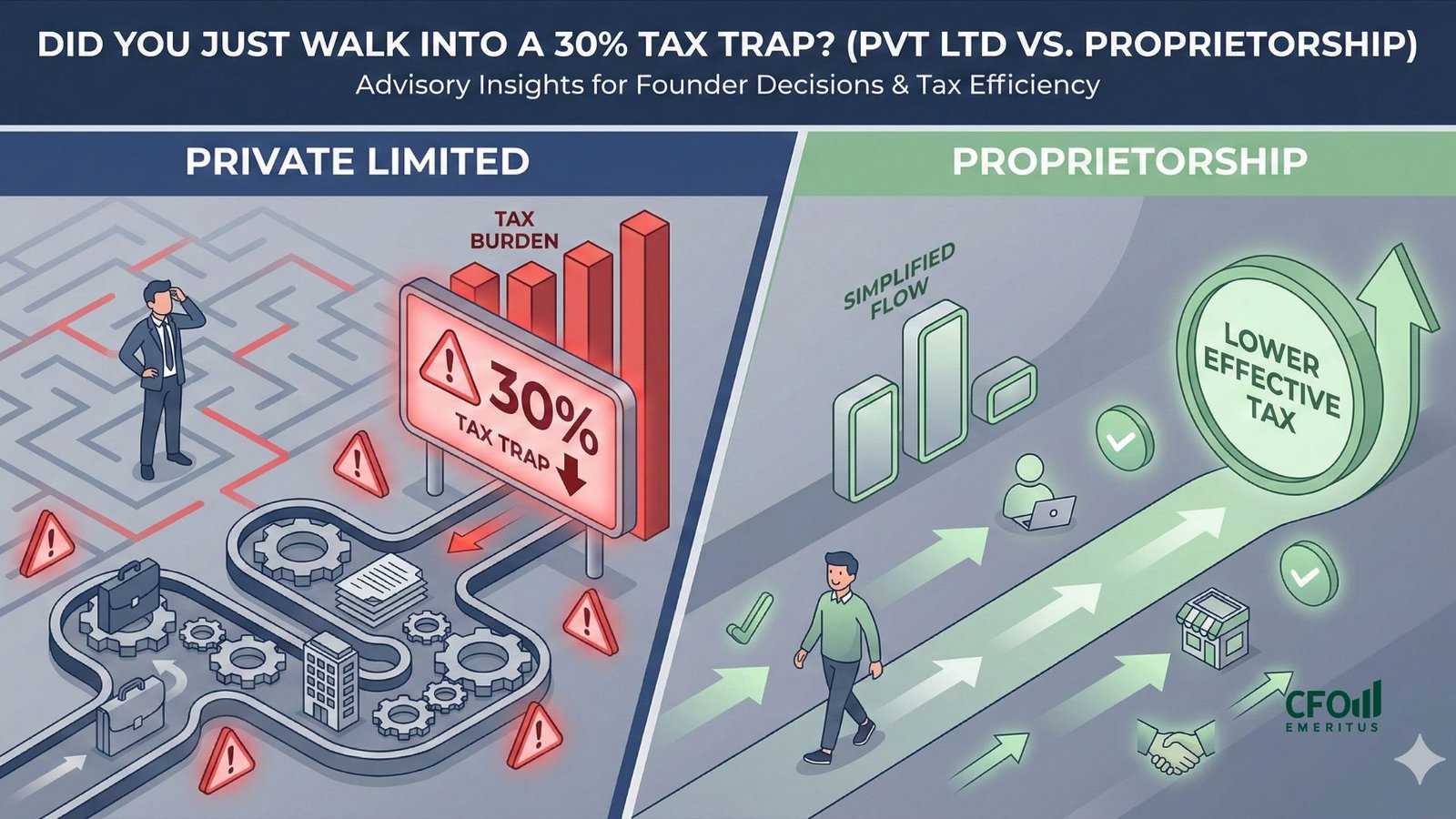

A founder rushes to incorporate a Private Limited Company on Day 1 because it “looks professional.” They get the Certificate of Incorporation, feel like a “real” CEO, and celebrate.

But unless you are raising VC money in the next 12 months, you might have just walked into a tax trap.

Most early-stage founders don’t realize that the wrong structure doesn’t just cost you compliance fees—it costs you flat tax on money that could have been tax-free.

Let’s look at the math that most Company Secretaries won’t show you.

The “Presumptive” Math (30% vs. 0%)

The Income Tax Act has a superpower for small businesses: Section 44AD. It allows you to declare a flat profit (6% or 8% of turnover) and skip the audit entirely.

But here is the catch: This superpower works best for Proprietorships.

Let’s say you make a net profit of ₹8 Lakhs.

👉 Scenario A: You are a Pvt Ltd / LLP

-

You pay a flat tax rate (approx. 25% – 30% depending on structure).

-

Tax Bill: ~₹2 Lakhs + Cess.

-

Compliance Cost: High.

👉 Scenario B: You are a Proprietorship

-

You opt for Section 44AD.

-

Your income is below the taxable threshold (after Section 87A rebate).

-

Tax Bill: ZERO.

By incorporating too early, you effectively volunteered to pay tax when you didn’t have to.

“What About a Partnership Firm?”

I see many founders forming a Partnership Firm with a spouse to split the income. Be very careful here.

If a Firm opts for Section 44AD (Presumptive Taxation), the law says: You cannot deduct Partners’ Salary or Interest from that presumptive profit.

That flat presumptive income is taxable at the firm’s flat rate (30%). So, even in a Partnership, you might end up paying higher taxes than a simple Proprietorship.

The Hidden Cost of “Looking Big”

Incorporating a Pvt Ltd isn’t a one-time cost. It’s a subscription to headaches. By incorporating too early, you sign up for:

-

Mandatory Audits: Even if your revenue is ₹0, you must audit your books.

-

ROC Compliance: Forms like AOC-4 and MGT-7 must be filed every year (penalties for delay are brutal).

-

Blocked Cash: You can’t just “take” money out of your own company. You have to take it as Salary (taxable) or Dividend (taxable). The money is trapped.

When is a Proprietorship the WRONG choice?

Don’t get me wrong. I love Private Limited companies. But only when the timing is right. You MUST upgrade to a Pvt Ltd if:

-

You need DPIIT Startup Recognition: Only Pvt Ltd/LLPs get the tax holidays and angel tax exemptions.

-

You are raising Equity Funding: VCs cannot invest in a Proprietorship.

-

You have High Liability Risks: A Proprietorship has unlimited liability (your personal assets are at risk). A Pvt Ltd protects you.

Final Thought

If you are a freelancer, a trader, or a service provider just starting out: Start simple.

Save the ₹50k annual compliance cost. Save the 30% flat tax. Start as a Proprietorship.

Don’t buy a Ferrari (Pvt Ltd) when you just need a reliable Scooter (Proprietorship) to cross your first ₹50 Lakhs.

📩 Confused about your business structure? We help founders choose the structure that saves tax today, not just looks good on paper. Write to us at office@cfoemeritus.com